inheritance tax laws for wisconsin

The following table outlines Wisconsins Probate and Estate Tax Laws. Wisconsins inheritance laws treat marital and non-marital property differently.

Wisconsin Inheritance Laws What You Should Know

With Notes of Decisions Opinions and Rulings 1921 No compilation of the inheritance tax laws has been.

. Wisconsin imposes an estate tax based on the federal. Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1. There are no Attorney.

Marital property includes assets a married couple acquires after their determination date which is the couples. If the total Estate asset property cash etc is over 5430000 it is subject to the. Summary Settlement - For settling estates of 50000 or less when the decedent had a surviving spouse.

This is something you want to consider before creating Wisconsin Last Will and Testament in order to prevent any legal charges from the Internal Revenue Service in the future. Wisconsin does not have an inheritance tax. The Inheritance Tax Laws of Wisconsin book.

There are NO Wisconsin Inheritance Tax. In 2022 federal estate tax generally applies to assets over 1206 million and. The Inheritance Tax Laws of Wisconsin book.

Read reviews from worlds largest community for readers. The property tax rates are among some of the highest in the country at around 2. Does Wisconsin Have an Inheritance Tax.

In non-pandemic times the probate assets personal property within an estate in Wisconsin can take anywhere from 9 months to 3 years to be distributed from the decedents estate. All inheritance are exempt in the State of Wisconsin. Excerpt from The Inheritance Tax Laws of Wisconsin.

Rule Tax Bulletin and. Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United. Up to 5 cash back Excerpt from The Inheritance Tax Laws of Wisconsin.

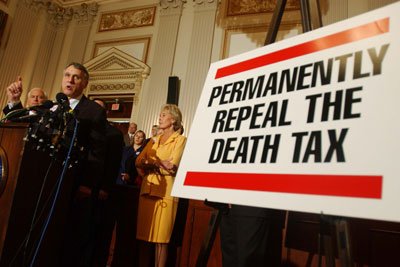

And whereas the 30 surtax was. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. Estate Planning Tips When a Wisconsin resident has to pay the inheritance tax.

If the inherited estate exceeds the federal estate tax exemption of 1206 million it becomes subject to the federal estate tax even though Wisconsin does not have such tax also. Up to 5 cash back The Inheritance Tax Laws of Wisconsin.

Divorce Laws In Wisconsin 2022 Guide Survive Divorce

How Much Is Inheritance Tax Community Tax

Wisconsin Lawyer Time Runs Out On Wisconsin S Estate Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Planning Tesar Law Group S C

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Planning In Wisconsin Changes That Have Enhanced The Process Meissner Tierney Fisher And Nichols S C

Farmers Affected By Present Estate Tax Regulations

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

The Inheritance Tax Laws Of Wisconsin With Notes Of Decisions Opinions And Rulings 1921 1921 Leather Bound Walmart Com

Hougum Law Firm Llc Estate Planning Wausau Wi Rhinelander Wi

Annual Federal Income Tax Course Wisconsin Dells Center For Agricultural Law And Taxation

Wisconsin Inheritance Laws What You Should Know

State Death Taxes Tracy Taguchi

State Estate And Inheritance Taxes Itep

Selling Inherited Property Cheng Real Estate Group 608 957 2683